With the beginning of the new year, entrepreneurs face the question: is it worth changing the taxation system? We would like to remind you that this can be done by 20 February by submitting an application via CEIDG, but it is better not to delay, because this date is not only the final deadline for submitting the application, but also the last day for paying taxes for January under the new system.

Important: it is necessary to inform your accountant that you have changed the taxation system.

We will review the existing taxation systems, their features and differences in order to help you make a well-considered decision.

Taxation systems for sole proprietors in Poland:

- General rules (zasady ogólne or skala podatkowa)

- Flat tax (podatek liniowy)

- Lump-sum tax on registered revenue (ryczałt od przychodów ewidencjonowanych)

Let us review the features of each of them in turn.

1. General rules (zasady ogólne, skala podatkowa)

This is the basic form of taxation used by most taxpayers, including employees.

Tax is calculated based on income (total revenue minus total expenses).

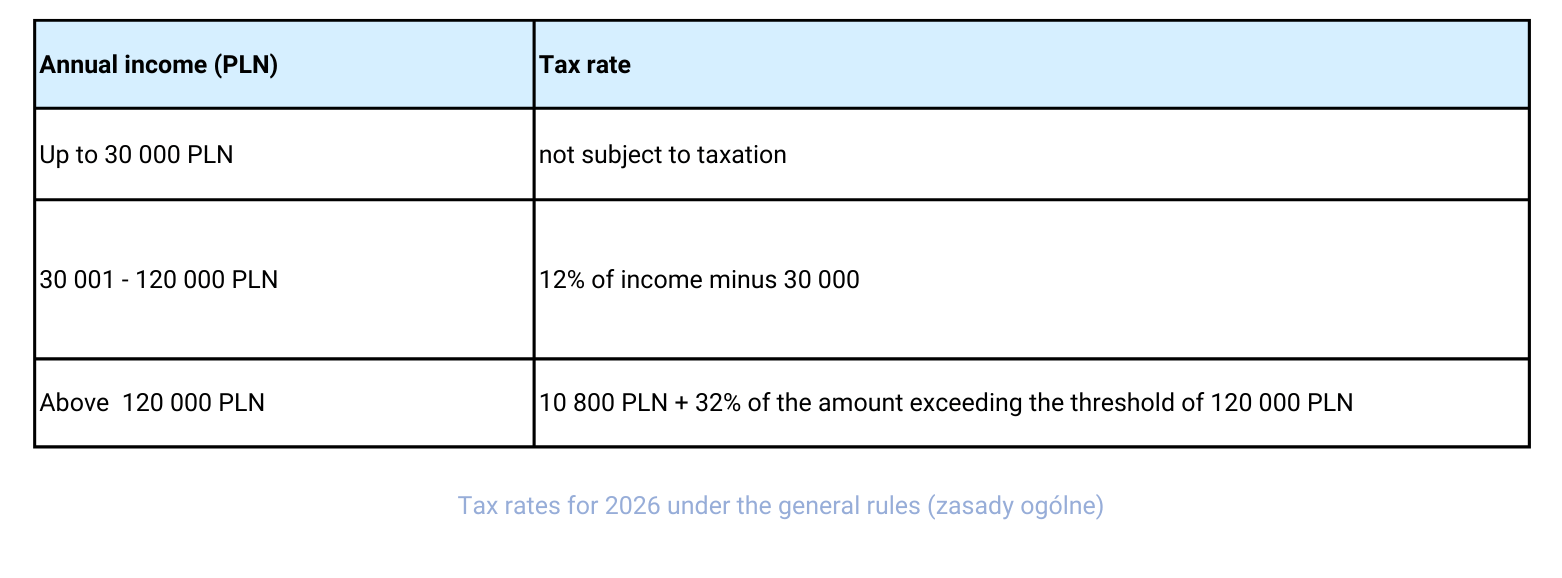

Tax rates: 0% → 12% → 32% — depending on the amount of annual income.

Features:

- The possibility to file an annual tax return jointly with a spouse or a child (joint taxation), which doubles the thresholds (a tax-free allowance of 60,000 and a threshold of 240,000 for the 12% rate — in total for two persons).

- All income received during the year is aggregated, including income from sole proprietorship, income from employment under an employment contract, income from civil-law contracts, income from non-registered activity, income from abroad, etc., taxed under the general taxation system.

- The possibility to reduce the taxable base by the amount of social security contributions paid to ZUS.

- The possibility to take ZUS contribution holidays for any month of the year.

- The possibility to apply the IP Box relief.

- The possibility to apply the child allowance (Ulga na dzieci).

- The possibility to apply the return-to-Poland relief (Ulga na powrót).

- VAT refunds are available for purchases related to business activity, provided that the sole proprietor is registered for VAT in Poland (active VAT taxpayer).

There are also a number of other, less common and more specific tax reliefs. More detailed information on all available reliefs can be found at.

Calculation of the ZUS health insurance contribution (Składka zdrowotna):

Under the general taxation system, the health insurance contribution amounts to 9% of income, but not less than 9% of the minimum wage.

In 2026, the minimum contribution amounts to PLN 432.54 (9% of the minimum wage of PLN 4,806).

Calculation of ZUS social security contributions (Składki społeczne):

The amount of social security contributions payable to ZUS depends on the “rate scheme” under which the sole proprietor falls in a given month of business activity:

- ZUS Preferential (ZUS Preferencyjny):

- without the voluntary sickness, maternity and accident insurance contribution (składka chorobowa): PLN 420.87,

- with the voluntary sickness, maternity and accident insurance contribution (składka chorobowa): PLN 456.19.

- Large ZUS (Duży ZUS):

- without the voluntary sickness, maternity and accident insurance contribution (składka chorobowa): PLN 1,788.29,

- with the voluntary sickness, maternity and accident insurance contribution (składka chorobowa): PLN 1,926.76.

- Small ZUS Plus (Mały ZUS Plus):

- the contribution amount is calculated individually depending on the annual income for the previous calendar year (it must be below PLN 120,000, with more than 60 days of business activity during the year; if the activity was carried out for an incomplete year, the income limit is calculated proportionally to the number of days worked).

- Start-up relief (Ulga na Start):

- during this period, the sole proprietor is exempt from paying social security contributions.

This taxation system is suitable for sole proprietors with relatively low income or with a high proportion of expenses in total revenue.

2. Flat tax (podatek liniowy)

The flat tax provides for a fixed tax rate of 19%, regardless of the amount of annual income. Tax is also calculated on the basis of income (total revenue minus total expenses).

Features:

- It is not possible to use tax reliefs such as IP Box, child allowance (Ulga na dzieci), and others.

- It is not possible to file a joint tax return with a spouse or a child.

- It is possible to take ZUS contribution holidays for any month of the year.

- To reduce the taxable base, paid health insurance contributions to ZUS may be deducted up to a limit of PLN 14,100, as well as paid social security contributions.

- This taxation system cannot be applied when working with a former employer (until the end of the year in which work was performed under an employment contract).

- VAT refunds are available for purchases related to business activity, provided that the sole proprietor is registered for VAT in Poland (active VAT taxpayer).

Calculation of the ZUS health insurance contribution (Składka zdrowotna)

Under the flat tax system, the health insurance contribution amounts to 4.9% of income, but not less than 9% of the minimum wage.

In 2026, the minimum contribution amounts to PLN 432.54 (9% of the minimum wage of PLN 4,806).

Calculation of ZUS social security contributions (Składki społeczne)

The amount of social security contributions payable to ZUS under the flat tax system is the same as under the general taxation system and depends on the “rate scheme” applicable to the sole proprietor in a given month of business activity.

Thus, it can be concluded that this taxation system is suitable for entrepreneurs with a high level of income, where expenses also play a significant role.

3. Lump-sum tax (ryczałt od przychodów ewidencjonowanych)

Under this taxation system, tax is calculated on the basis of revenue, meaning that expenses are not taken into account. The tax rate depends on the type of activity and may be 17%, 15%, 14%, 12.5%, 12%, 10%, 8.5%, 5.5%, or 3%.

Features:

- The return-to-Poland relief (Ulga na powrót) may be applied.

- It is not possible to use tax reliefs such as IP Box, child allowance (Ulga na dzieci), and others.

- VAT refunds are available for purchases related to business activity, provided that the sole proprietor is registered for VAT in Poland (active VAT taxpayer).

- If employees are hired, their salaries, as well as related taxes and ZUS contributions, are not treated as expenses and do not reduce the tax base.

- It is not possible to file a joint tax return with a spouse or a child.

- It is possible to take ZUS contribution holidays for any month of the year.

- The taxable base may be reduced by ZUS contributions: 100% of social security contributions and 50% of health insurance contributions.

- Income taxed under the lump-sum system is not combined with income from other sources (employment under an employment contract, civil-law contracts, non-registered activity, income from abroad, etc.).

- Certain types of activity are not eligible for the lump-sum system (for example, pharmacies, trading in cars and car parts, currency trading, excisable goods, etc.).

- There is a revenue limit of EUR 2,000,000; once this limit is exceeded, the entrepreneur is required to switch to general rules or the flat tax.

- A sole proprietor may not apply this taxation system when cooperating as a sole proprietor with a former employer for the same type of work, in the current year and in the year following the year in which the employment relationship existed.

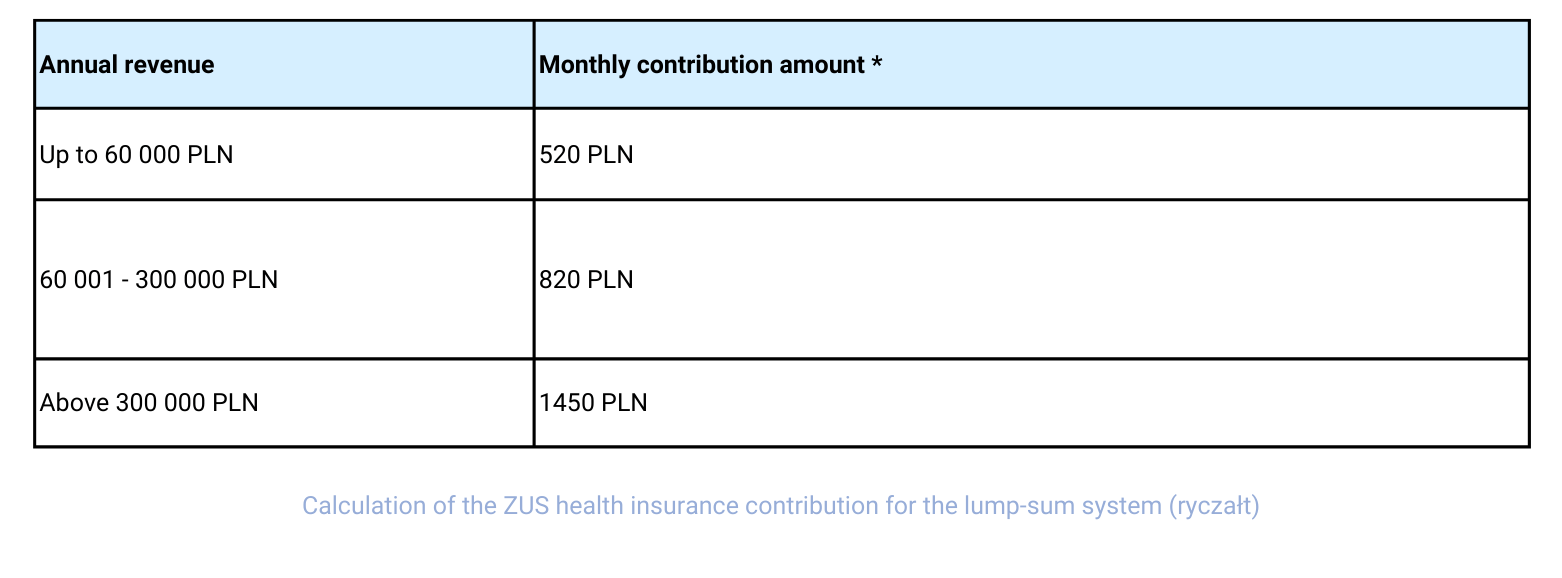

Calculation of the ZUS health insurance contribution (Składka zdrowotna)

Under the lump-sum system, the health insurance contribution has three fixed levels, and the applicable level depends on the amount of annual revenue. The contribution amounts themselves are linked to the average monthly income in Poland for the fourth quarter of the previous year.

* At the time this article was written, the average monthly income for the fourth quarter of 2025 was not yet known; therefore, the contribution amounts provided are estimated, based on trends from previous years. The exact contribution amounts will be announced in the second half of January 2026. Estimated variance: ± PLN 20.

Calculation of ZUS social security contributions (Składki społeczne)

The amount of social security contributions payable to ZUS under the lump-sum system is the same as under the general taxation system and depends on the “rate scheme” applicable to the sole proprietor in a given month of business activity.

In conclusion, the lump-sum taxation system is suitable for sole proprietors who conduct activities with low operating costs (for example, programmers, bloggers, trainers) or whose activities fall within groups subject to low tax rates of 3%, 5.5%, or 8.5%.

Next, we propose to review practical examples.

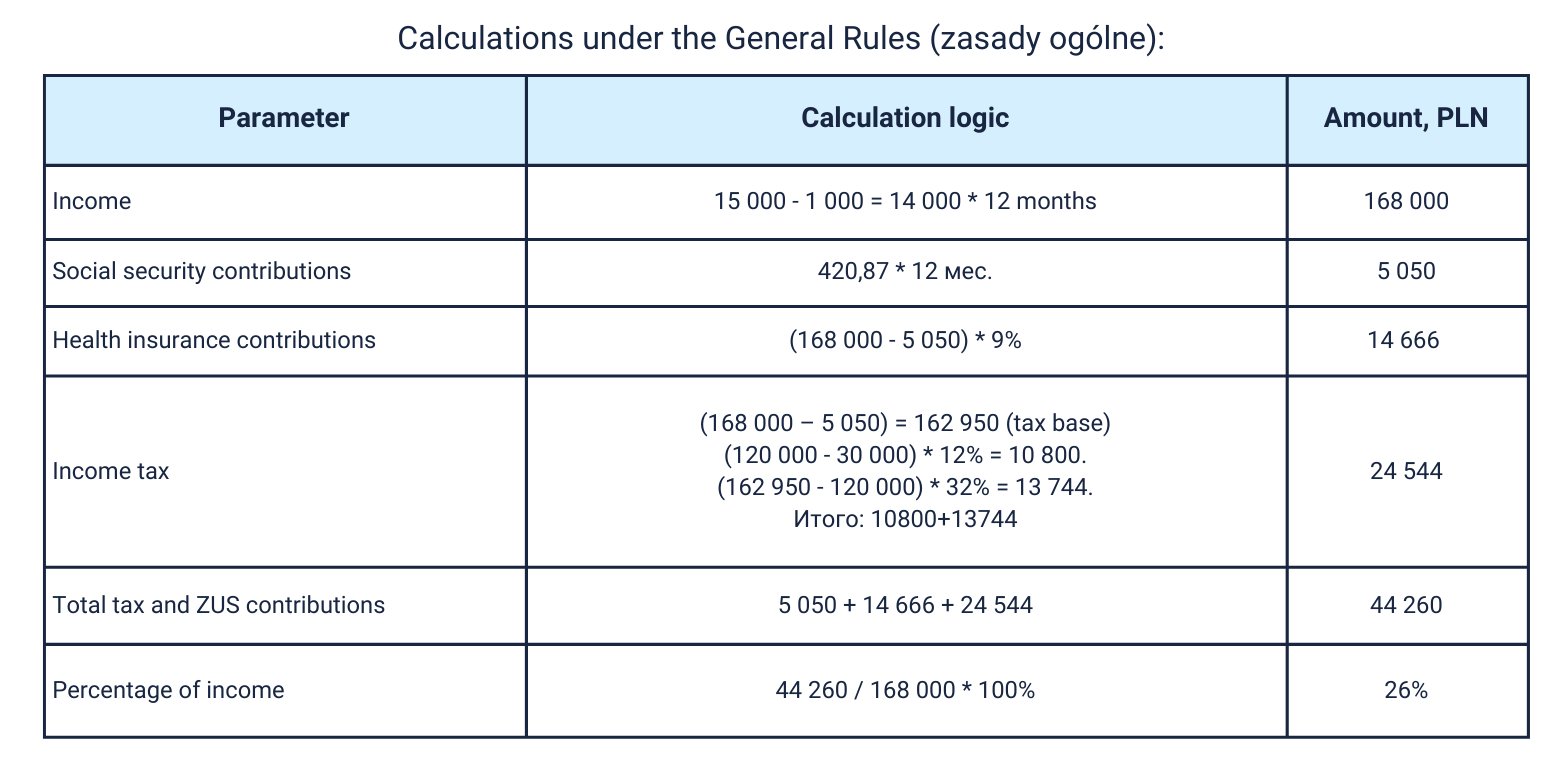

Example 1

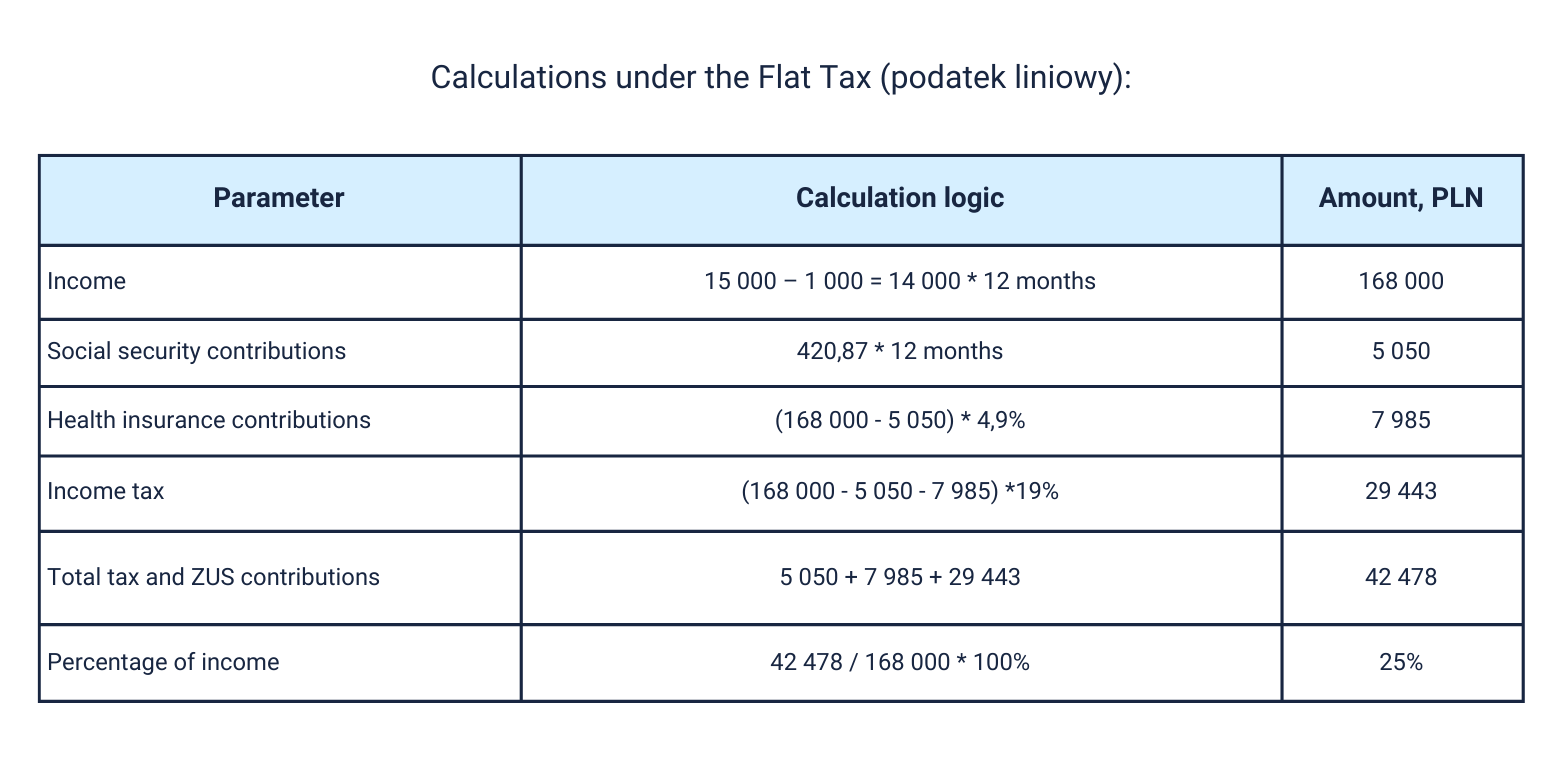

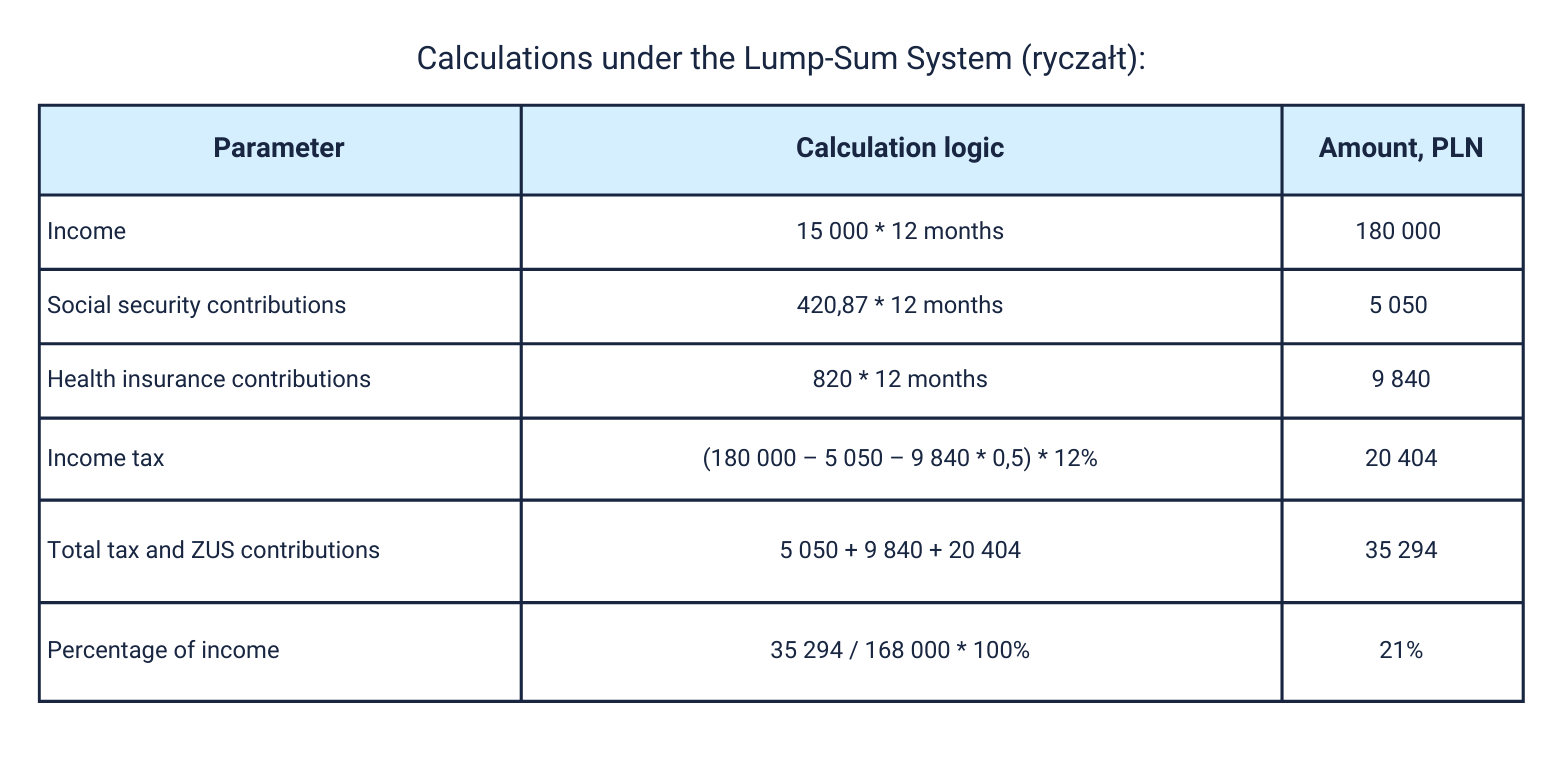

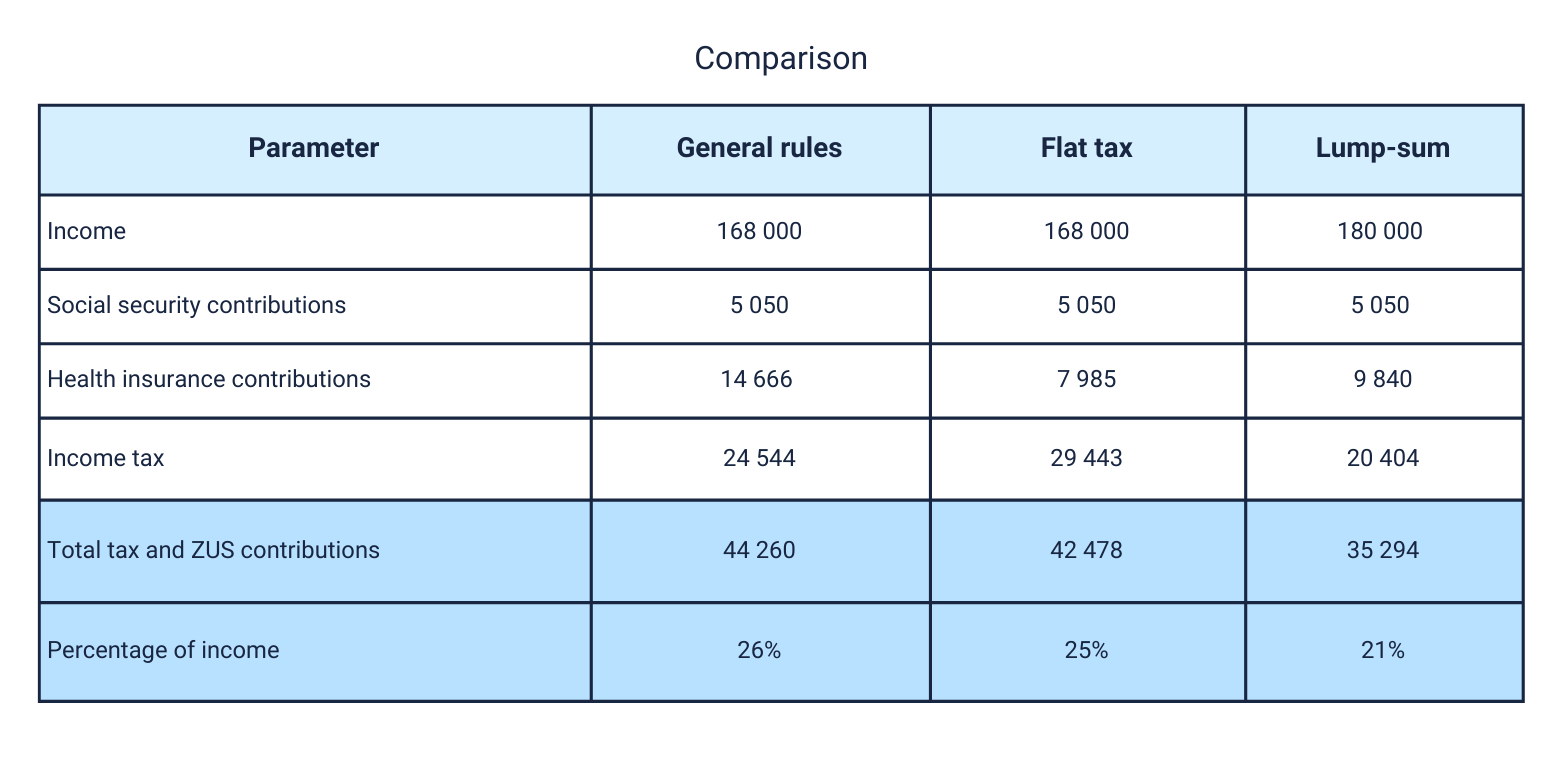

The entrepreneur generates revenue of PLN 15,000 per month, with monthly expenses of PLN 1,000. The tax rate under the lump-sum system is 12%. For ZUS purposes, the entrepreneur is covered by Preferential ZUS (ZUS Preferencyjny).

For clarity, all figures have been rounded to whole zlotys.

The most advantageous taxation system for an entrepreneur with these parameters is the lump-sum system.

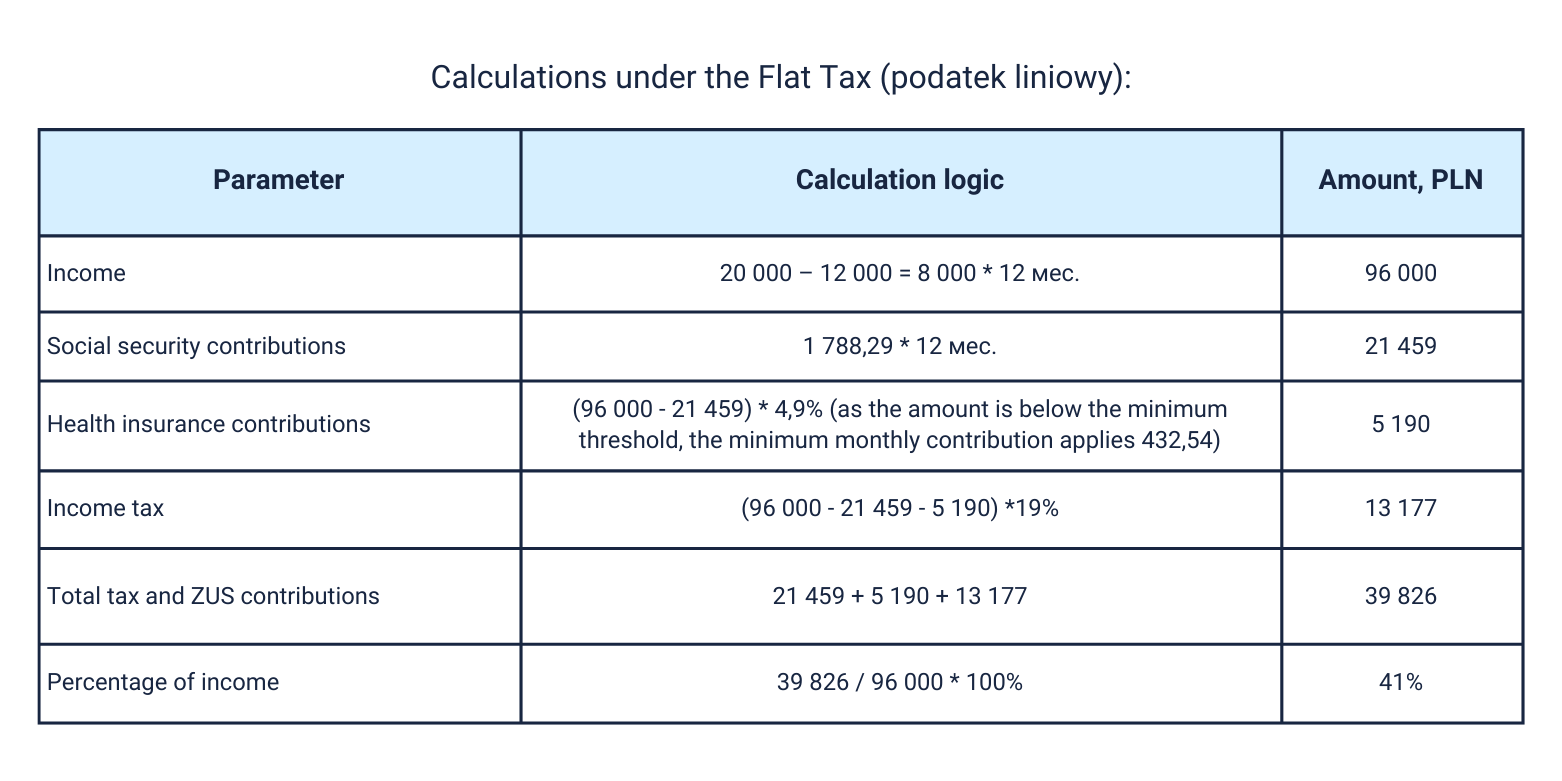

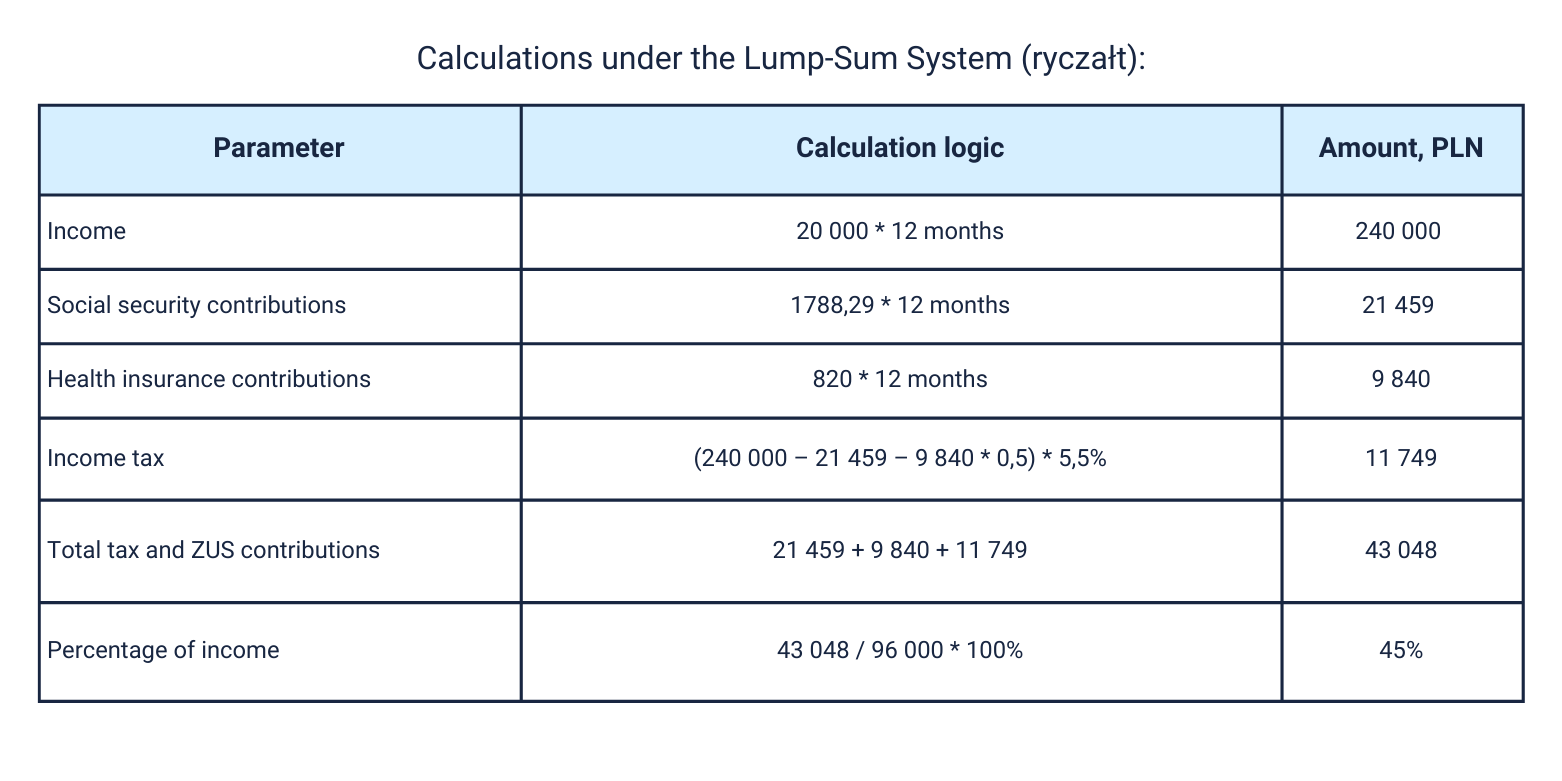

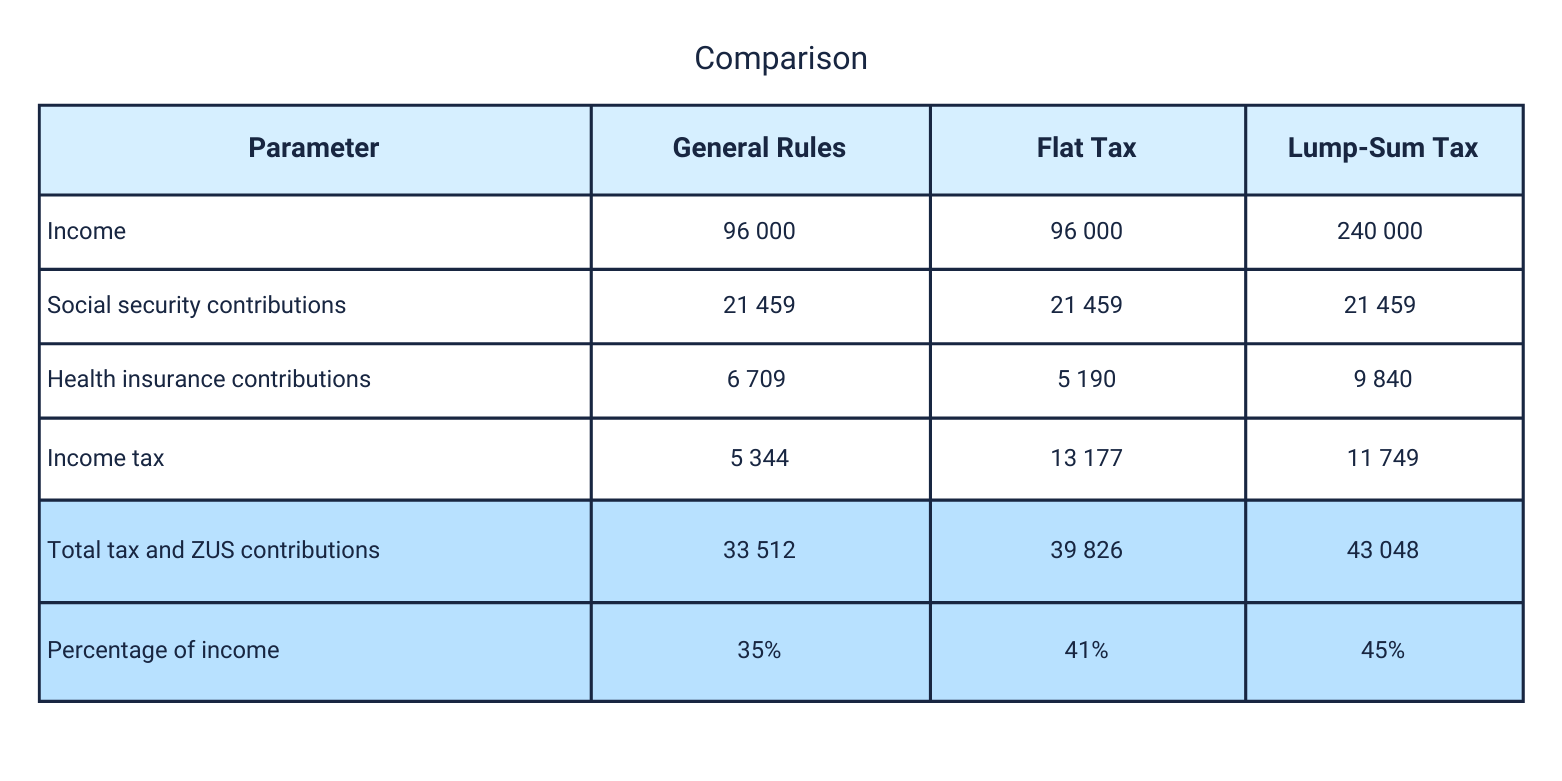

Example 2

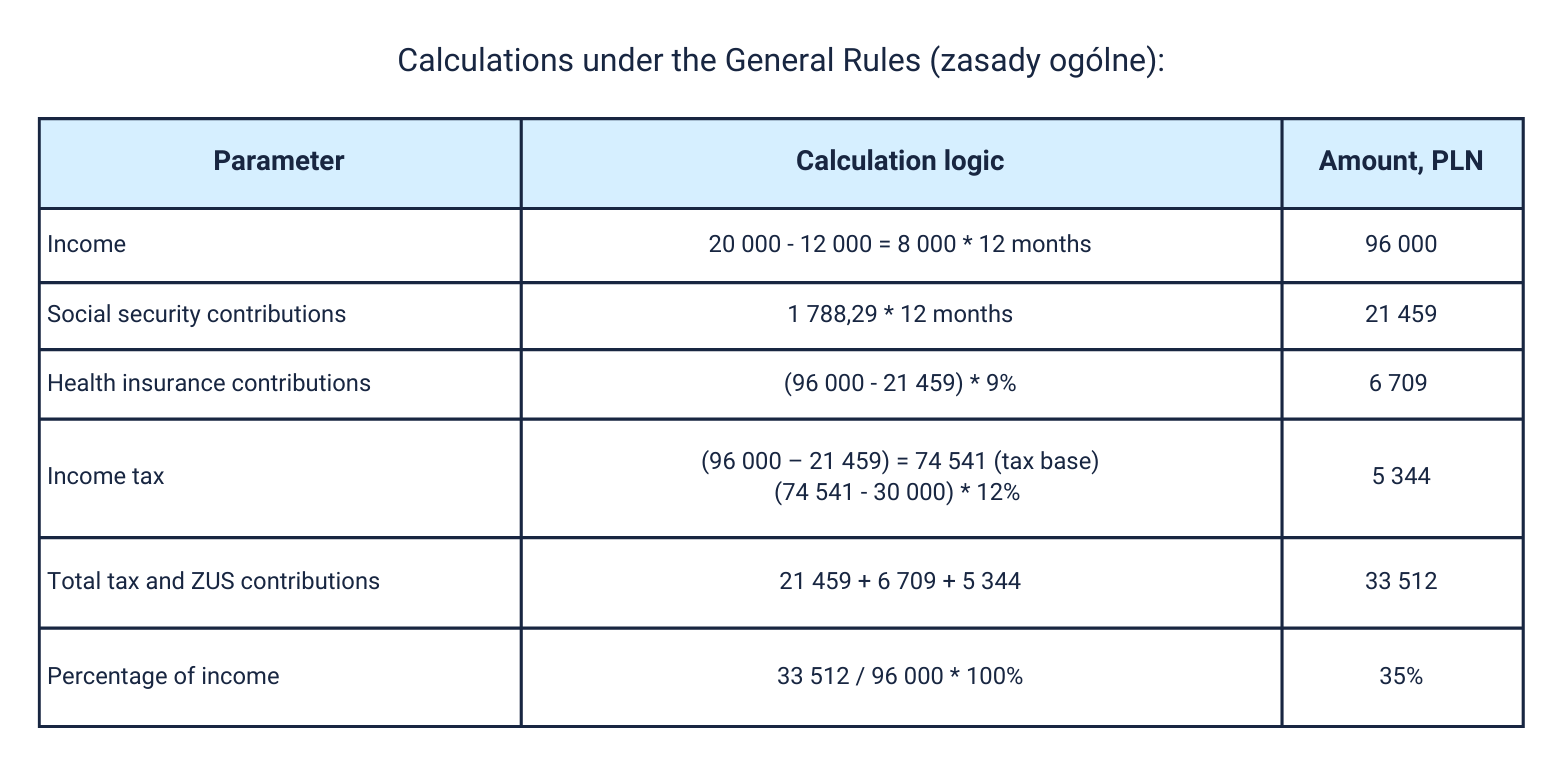

The entrepreneur generates revenue of PLN 20,000 per month, while monthly expenses amount to PLN 12,000. The tax rate under the lump-sum system is 5.5%. For ZUS purposes, the entrepreneur is subject to Large ZUS (Duży ZUS).

For clarity, the figures have been rounded to whole zlotys.

The most advantageous taxation system for an entrepreneur with these parameters is the general taxation system.

Important:

It should be noted that in each individual case, the final result may be influenced by every applied tax relief or specific feature of the taxation system (for example, a non-working spouse, the return-to-Poland relief, the employment of an employee, etc.).

Therefore, the more nuances are taken into account, the more accurate the calculation can be.

Conversely, making only a very approximate forecast without considering all input data may, in practice, lead to the opposite result by the end of the year.

If you are considering changing your taxation system or have doubts about your calculations, please contact us. We offer an additional service that includes calculating and analyzing your specific situation based on your individual input data — our specialists will help perform the calculations and select the optimal solution for your business activity.

Deadline for submitting a request for the calculation of the optimal taxation system: 31 January 2026.